How Much Will My Check Be

Free Paycheck Calculator: Hourly & Salary - SmartAsset

How Your Paycheck Works: Income Tax Withholding. When you start a new job or get a raise, you’ll agree to either an hourly wage or an annual salary. But calculating your weekly take-home pay isn’t a simple matter of multiplying your hourly wage by the number of hours you’ll work each week, or dividing your annual salary by 52.

https://smartasset.com/taxes/paycheck-calculator

Social Security increase 2023: How much will my check be?

According to the Social Security Administration, the average monthly benefit as of June is $1,542.22. A 10.5 increase would be the first time a COLA has reached double digits since 1982 when it hit...

https://www.al.com/news/2022/08/social-security-increase-2023-how-much-will-my-check-be.html

Calculate your paycheck with paycheck calculators and withholding ...

Use PaycheckCity's free paycheck calculators, gross-up and bonus and supplementary calculators, withholding forms, 401k savings and retirement calculator, and other specialty payroll calculators for all your paycheck and payroll needs. Salary and Hourly Calculators Salary Calculator Determine your take-home pay or net pay for salaried employees.

https://www.paycheckcity.com/calculator/

Free Online Paycheck Calculator | Calculate Take Home Pay | 2022

This online paycheck calculator with overtime and claimed tips will estimate your net take-home pay after deductions and federal, state, and local income tax withholding. You can choose between weekly, bi-weekly, semi-monthly, monthly, quarterly, semi-annual, and annual pay periods, and between single, married, or head of household.

https://www.free-online-calculator-use.com/free-online-paycheck-calculator.html

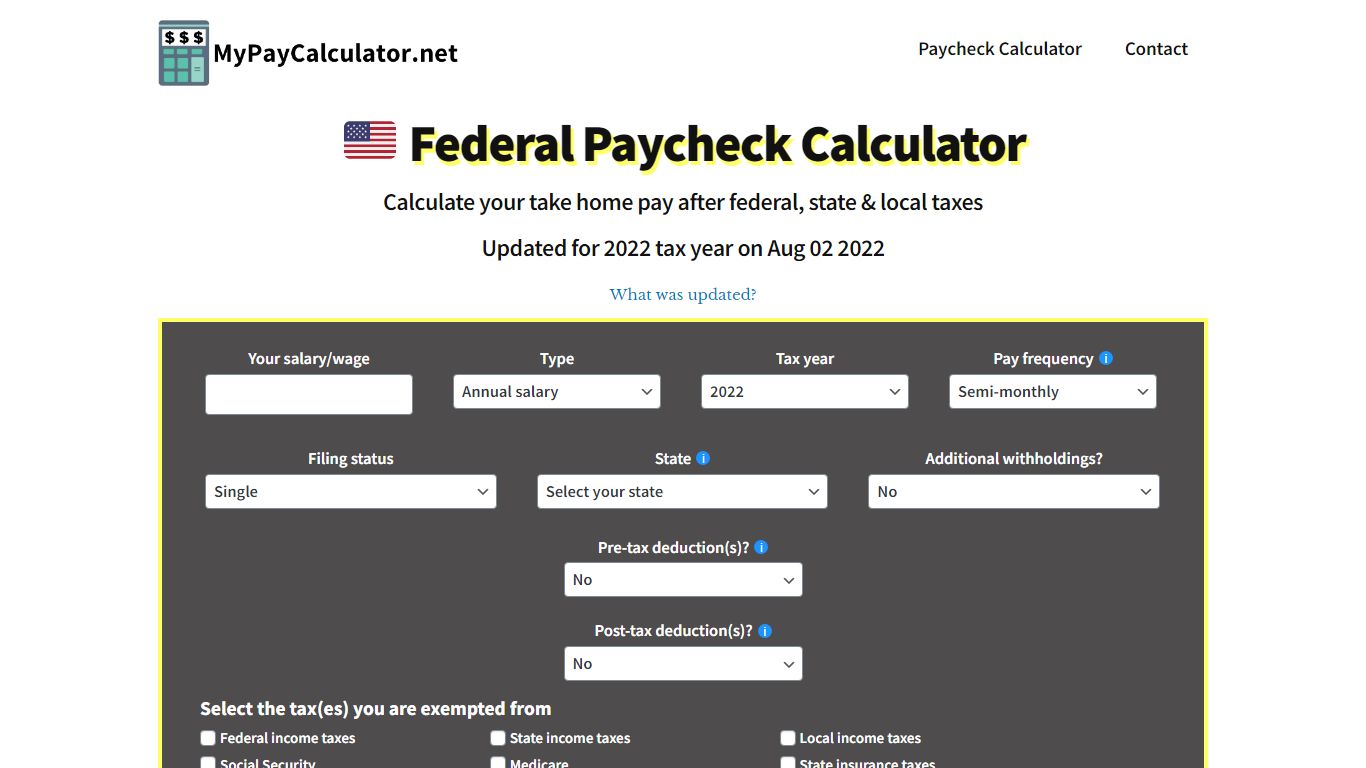

Free Paycheck Calculator | Tax year 2022 - MyPayCalculator.net

For single filer, you will receive $2,824.96 every month after federal tax liability. For married filed joinly with no dependent, the monthly paycheck is $2,960.83 after federal tax liability. How much is 75k a paycheck? Paycheck after federal tax liability for single filer: Monthly - $4,999.54 Bi-weekly - $2,307.48 Weekly - $1,153.74

https://www.mypaycalculator.net/us-paycheck-calculator/

Salary Paycheck Calculator – Calculate Net Income | ADP

How to calculate annual income To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual’s annual income would be 1,500 x 52 = $78,000. How to calculate taxes taken out of a paycheck

https://www.adp.com/resources/tools/calculators/salary-paycheck-calculator.aspx

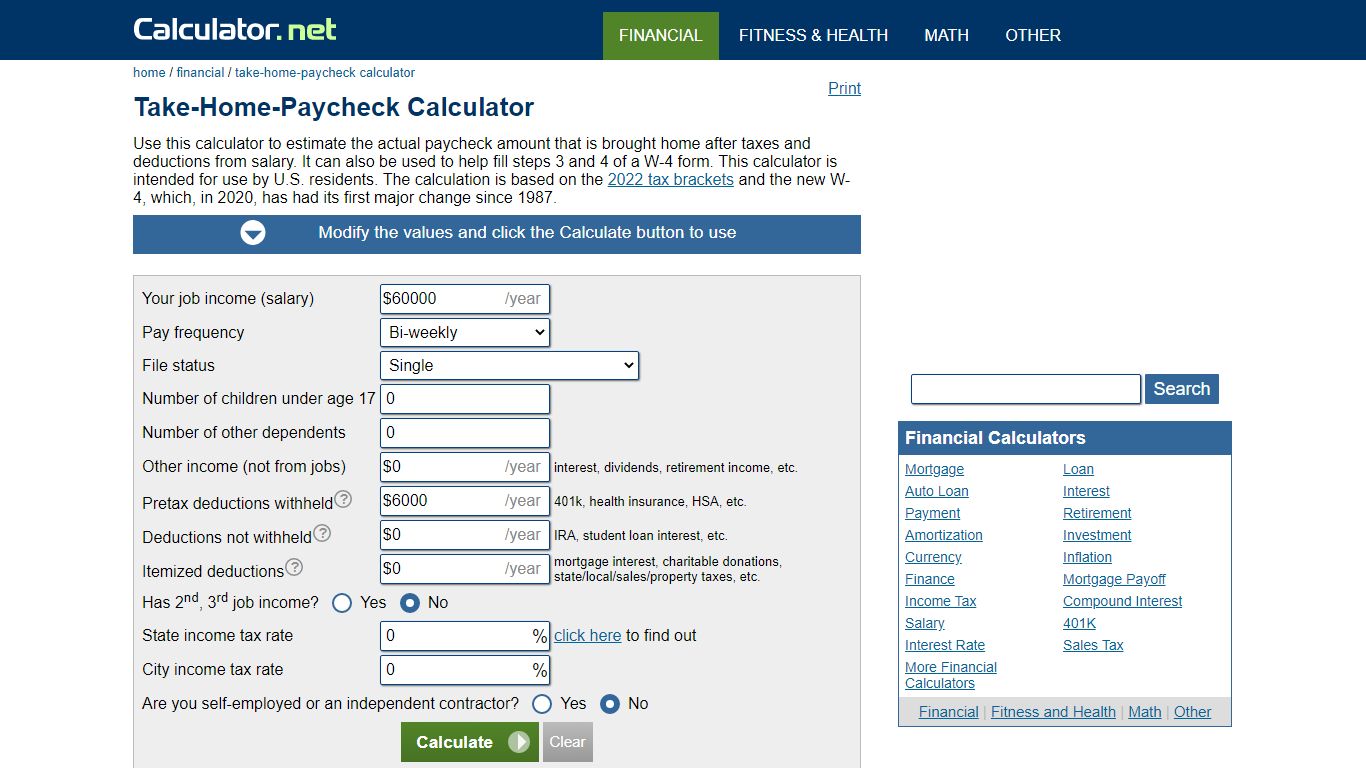

Take-Home-Paycheck Calculator

Incomes above the threshold amounts will result in an additional 0.45% (total including employer contribution: 0.9%) on top of the regular Medicare tax rate. Take Home Pay Only after all of these factors are accounted for can a true, finalized take-home-paycheck be calculated. Figuring out this final figure can be helpful.

https://www.calculator.net/take-home-pay-calculator.html

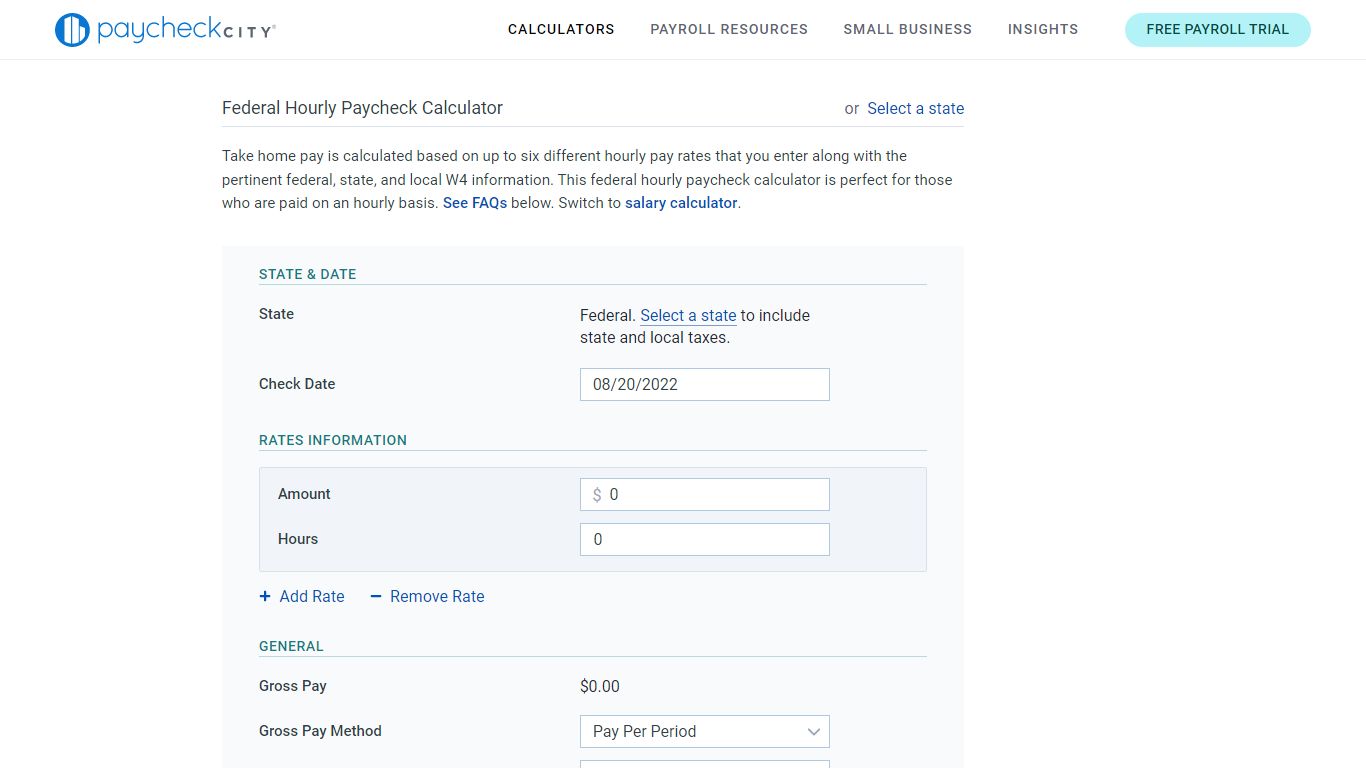

Hourly Paycheck Calculator · Hourly Calculator · PaycheckCity

Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local W4 information. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. See FAQs below.

https://www.paycheckcity.com/calculator/hourly/

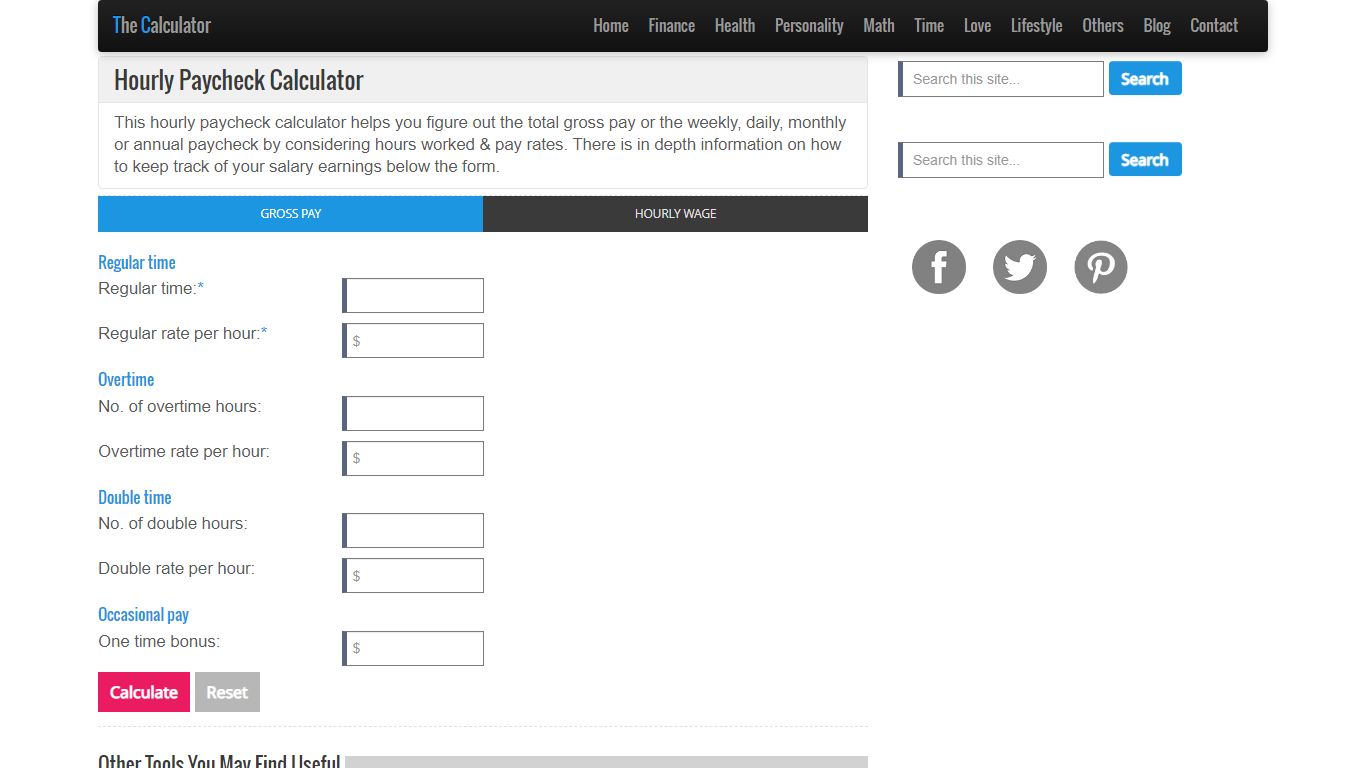

Hourly Paycheck Calculator

This finance application offers two methods to estimate either: your gross pay by taking into consideration the regular, overtime and double hours worked and their pay rate as well as any occasional bonuses; or your hourly, daily, monthly and annual salary by considering how much you get paid and how much you work per day and week.

https://www.thecalculator.co/finance/Hourly-Paycheck-Calculator-512.html

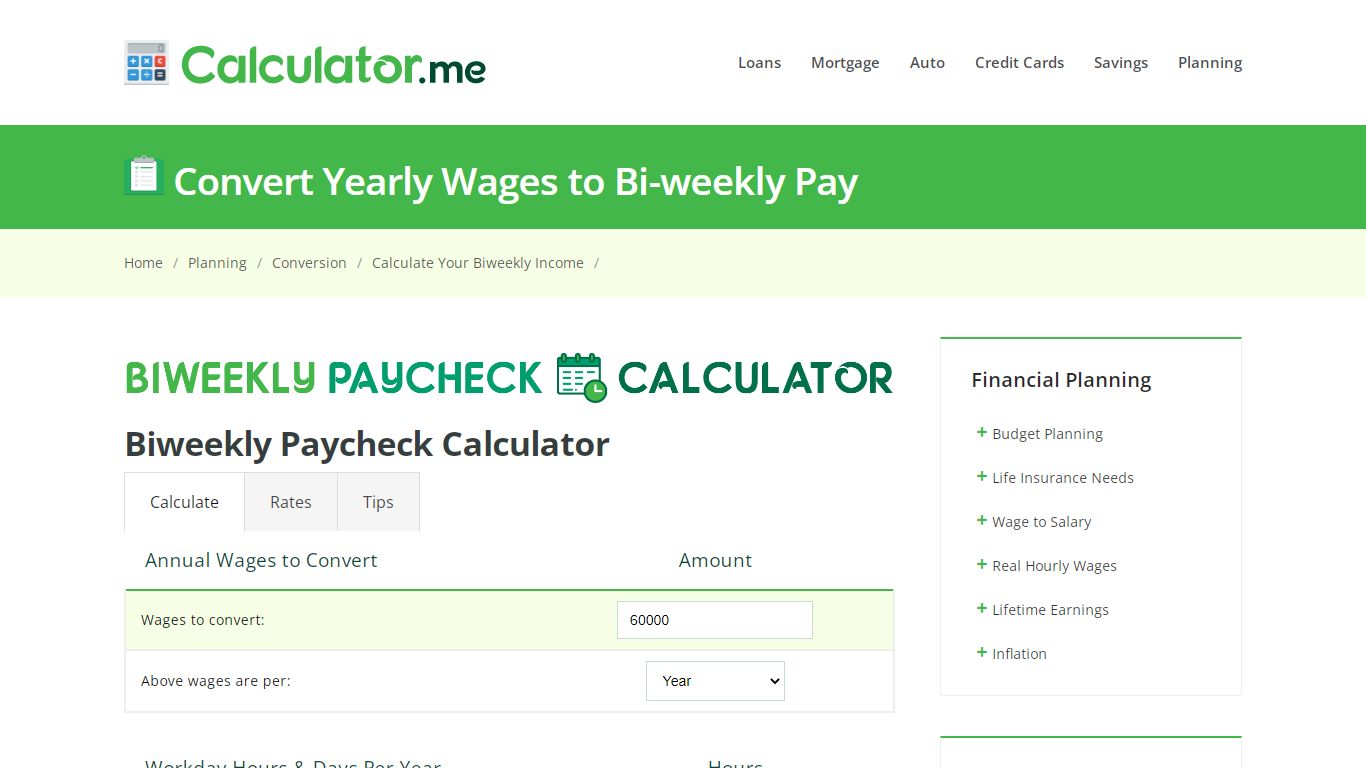

Annual Salary to Biweekly Paycheck Conversion Calculator

How Much Will Your Biweekly Paycheck Be? Each year has 52 weeks in it, which is equivalent to 26 biweekly pay periods. Many employers give employees 2 weeks off between the year end holidays and a week of vacation during the summer. The following table highlights the equivalent biweekly salary for 48-week, 50-week & 52-week work years.

https://calculator.me/planning/annual-to-biweekly.php

How to check if you have an uncashed CRA cheque – and get your money

There are three ways to register and sign into your account: Using the same sign-in information you use for online banking. Using your CRA user ID and password. Registering for a CRA user ID ...

https://www.theglobeandmail.com/business/article-canada-revenue-agency-uncashed-cheques/